Summary

- The U.S. added 254,000 jobs in September, surpassing the estimate of 140,000.

- The dollar hits its highest level since August.

- U.S. 10-year Treasury yield rises, oil prices climb amid concerns over the Middle East.

NEW YORK/LONDON, Oct 4 (AfrikTimes) – MSCI’s global equities index rose on Friday while the dollar climbed to its highest level since mid-August as investors heaved a sigh of relief on news of a surprisingly strong U.S. labor market.

However, oil prices settled higher for a fourth consecutive session as investors braced for a potential Israeli strike on Iranian energy infrastructure.

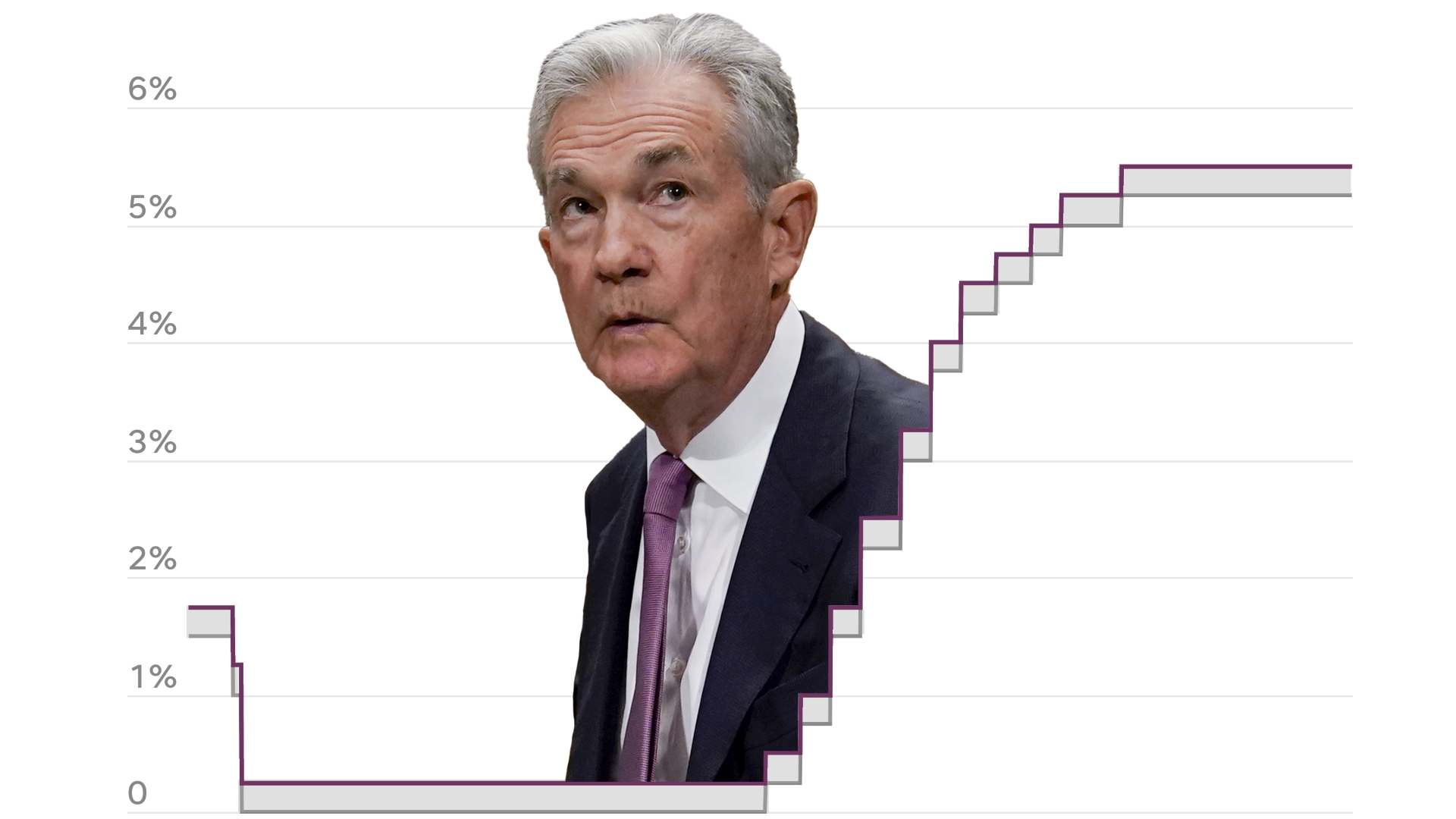

Earlier on Friday, the U.S. Bureau of Labor Statistics said 254,000 workers were added to nonfarm payrolls last month, above the 140,000 economists had estimated, while August’s data was revised higher, and the 4.1% unemployment rate was lower than expected. U.S. Treasury yields rose to their highest level since early August and traders ditched bets that the Federal Reserve will cut rates by half a percentage point next month after the jobs report.

The German share price index DAX graph is pictured at the stock exchange in Frankfurt, Germany, October 3, 2024. REUTERS.

The German share price index DAX graph is pictured at the stock exchange in Frankfurt, Germany, October 3, 2024. REUTERS.

The Fed is now more likely to lower rates by only a quarter percentage point at its next meeting, said Julia Hermann, global market strategist at New York Life Investments. “U.S. equities reaction to these very strong jobs growth confirms that investors are most concerned about economic growth” even when it comes with a “hawkish disruption,” she said. “The fact the market has been able to digest this hawkish shift points to a constructive view about the economic outlook,” Hermann added, pointing to moves in U.S. Treasuries as well as stocks.

Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., September 4, 2024. REUTERS/Brendan McDermid.

Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., September 4, 2024. REUTERS/Brendan McDermid. Bull statues are placed in font of screens showing the Hang Seng stock index and stock prices outside Exchange Square, in Hong Kong, China, August 18, 2023. REUTERS/Tyrone Siu.

Bull statues are placed in font of screens showing the Hang Seng stock index and stock prices outside Exchange Square, in Hong Kong, China, August 18, 2023. REUTERS/Tyrone Siu.