Naira Gains Stability Amid Reforms

Bloomberg Reports Boost in Investor Confidence

Summary

- The Nigerian Naira has shown signs of recovery in early 2025, appreciating by 3% since late 2024, largely due to strategic interventions by the Central Bank.

- Speaking at the Qatar Economic Forum, business magnate Tony Elumelu commended the Naira’s recent stability and highlighted its positive influence on investor confidence.

- Recent progress in the Naira’s performance has been driven by reforms such as the relaxation of foreign exchange controls, clearance of dollar demand backlogs, and an increase in dollar supply to the market.

- Despite these improvements, the Naira’s resilience was tested in March 2025 when falling oil prices and a decline in foreign reserves led to a temporary dip in value.

- The currency’s journey has been marked by volatility, including a 70% decline since 2023, followed by a gradual rebound propelled by ongoing corrective measures.

Qatar/Nigeria — Nigeria’s Naira has begun to stabilise in 2025 after a turbulent stretch marked by devaluations, inflationary surges, and declining foreign reserves. Bloomberg reports indicate that a combination of structural reforms, market interventions by the Central Bank of Nigeria (CBN), and rising foreign investor interest are gradually reversing the currency’s downward trajectory.

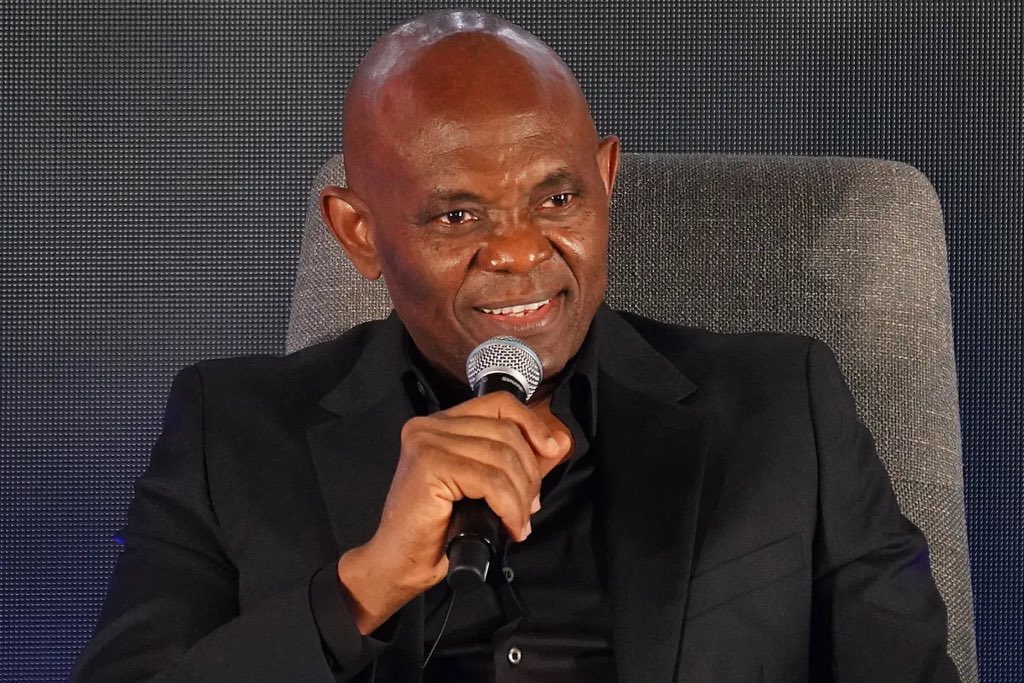

Prominent Nigerian entrepreneur Tony Elumelu added his voice to the growing confidence in the Naira’s outlook at the Qatar Economic Forum. Speaking as Chairman of United Bank for Africa and a member of Nigeria’s Presidential Economic Coordination Council, Elumelu remarked that the local currency’s newfound stability is reshaping investment prospects.

“The Naira is becoming quite stable,” Elumelu said during a Bloomberg-powered panel in Doha. “I’d like to see that continuing.”

Throughout May, the Naira has traded within a relatively narrow band of 1,588–1,611 per US dollar. This follows earlier fluctuations that saw the currency lose over 70% of its value since 2023. That decline was largely attributed to a policy pivot under President Bola Tinubu’s administration, which scrapped multiple exchange rates and encouraged market-determined pricing to boost liquidity.

One notable turning point came in February 2025, when the CBN extended dollar access to foreign exchange bureaus. The resulting increase in liquidity led to a 3% gain in the Naira’s value from ₦1,549 to ₦1,498.5 per USD between December 2024 and early February 2025.

Similarly, on April 2, the Naira rose 0.6% to ₦1,530 per dollar, buoyed by foreign reserves climbing past $40 billion, a three-year high. Yet, volatility persists.

A Bloomberg report on March 10 noted a 4% drop in the Naira’s value to ₦1,552 per USD, linked to a 15% decline in global oil prices and reduced interest in Nigerian money market assets. Analysts warned of vulnerability due to reserve drawdowns, which had fallen by $2.2 billion between January and February 2025.

Despite these setbacks, ongoing reforms such as the unification of exchange rates and relaxed remittance regulations have strengthened the Naira’s competitiveness. A World Bank economist observed in October 2024 that the Naira was at its most competitive real exchange rate level in two decades.

Inflation, another key pressure point, showed signs of easing from 35% in late 2024 to 24.5% in January 2025, aided by an updated Consumer Price Index methodology. However, Nigeria’s continued dependence on oil exports remains a structural risk to monetary stability.

Bloomberg’s historical lens underscores the cyclical nature of Nigeria’s exchange rate management. While the CBN achieved temporary stability in 2018, it did so at great cost to reserves and yields—a dynamic that reappeared as recently as April 4, 2025, when it injected $197.71 million into the market to counter tariff-driven pressures.

As Nigeria walks the tightrope of reform and resilience, figures like Elumelu emphasise the regional stakes of currency stability.

“Currency volatility is a challenge for Africa and Asia. Fixing the volatility of our currencies will be critical for ultimately developing our economies,” he said.

For now, signs of equilibrium—though tentative—suggest that Nigeria’s financial managers may be navigating the worst of the storm. Investors, both local and foreign, are watching closely.