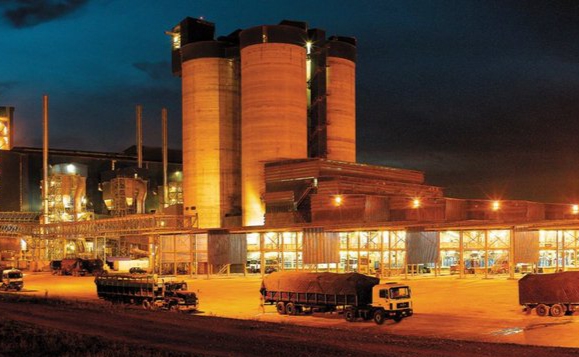

Dangote Refinery

Company to process 100% Nigerian crude by end of 2025

- Refinery currently sources 53% of crude locally, aims for full transition by December

- Five NNPC cargoes of nearly one million barrels each scheduled for July and August

- Move expected to reduce fuel imports, cut costs, and enhance energy security

Lagos, Nigeria – Dangote Industries Ltd. has announced plans to fully transition its massive 650,000-barrel-per-day refinery to using 100% Nigerian crude oil by December 2025. Located in the Lekki Free Zone near Lagos, the refinery is Africa’s largest and the world’s biggest single-train facility, representing a transformative step in Nigeria’s long-standing quest for energy self-sufficiency.

As of June 2025, the refinery was sourcing 53% of its crude domestically, with the remaining 47% imported, mainly from the United States. According to Devakumar Edwin, Vice President of Dangote Industries, the firm’s long-term international contracts are due to expire this year, paving the way for a complete shift to local crude supply.

To facilitate this change, the Nigerian National Petroleum Company Limited (NNPC) is set to deliver five cargoes of nearly one million barrels each in July and August 2025. The deliveries will increase the refinery’s reliance on domestic production, strengthening Nigeria’s control over its energy resources.

This shift is expected to displace hundreds of thousands of barrels of imported oil daily, significantly reducing the country’s dependency on costly refined fuel imports, a long-standing contradiction for Africa’s largest oil producer.

Despite its oil wealth, Nigeria has historically exported crude and imported refined products, a system plagued by inefficiencies, corruption, and high costs. The Dangote Refinery, commissioned in May 2023, is designed to reverse this by meeting all domestic fuel needs and exporting surplus, especially to West Africa.

Currently operating at 550,000 barrels per day, the plant plans to reach full capacity by the end of the year. It already produces Euro-V quality petrol, diesel, jet fuel, and polypropylene, with output poised to satisfy local demand and expand into global markets.

Securing sufficient local crude has been a persistent issue, with challenges including pipeline vandalism, oil theft, and international oil company divestments from the Niger Delta. These constraints forced Dangote to import crude from the U.S., Brazil, Angola, Ghana, and Equatorial Guinea in recent months, including 161,000 barrels per day from the U.S. in July 2025.

However, improved collaboration with the Nigerian government, security upgrades, and equity stakes offered to local producers are expected to boost the supply of Nigerian crude. This, coupled with the termination of NNPC’s exclusive petrol purchase deal in October 2024, is creating a more competitive and transparent fuel market.

The $19–20 billion refinery, backed by Africa’s richest man Aliko Dangote, is one of the continent’s most ambitious industrial undertakings. Its full operation is projected to create 135,000 permanent jobs, stabilise fuel prices, reduce inflation, and enhance Nigeria’s status as a regional fuel hub.

In addition to refining capabilities, the project includes a 435MW power plant and the world’s longest subsea pipeline system (1,100 km), designed for the transport of crude oil and natural gas.

To cut distribution costs and improve fuel access nationwide, Dangote has also invested over ₦720 billion in 4,000 Compressed Natural Gas (CNG)-powered trucks, set to roll out from August 2025. This initiative is expected to reduce logistics costs for marketers and benefit over 42 million Micro, Small, and Medium Enterprises (MSMEs).

The refinery’s output has already positioned Nigeria as a net exporter of diesel, petrol, and aviation fuel, with export markets in West Africa and plans for expansion to Europe and beyond.

While the shift to 100% local crude marks a milestone, challenges remain. These include upstream instability, especially in the Niger Delta, currency devaluation, which affects profitability, and policy inconsistency, highlighted by a temporary suspension of domestic crude supply in mid-2025.

Investor confidence also hinges on the stability of the naira-for-crude agreement with the NNPC and ongoing government support to tackle sabotage and theft in crude-producing regions.

The months ahead will be crucial in determining whether this landmark project can truly transform Nigeria from a raw exporter to a refined energy powerhouse**.