CBN Retains MPR at 27.50%

Economic Signals and Global Uncertainties remain Positive

Summary

- Monetary Policy Rate (MPR) held steady at 27.50%.

- Cash Reserve Ratio retained at 50% for Deposit Money Banks and 16% for Merchant Banks.

- Headline inflation dropped to 23.71% in April 2025.

- Food and core inflation also recorded declines.

- Gross external reserves rose to $38.90 billion.

- MPC acknowledges improved macroeconomic indicators and urges continued reforms.

- Concerns remain over high electricity prices, forex demand pressure, and declining crude oil prices.

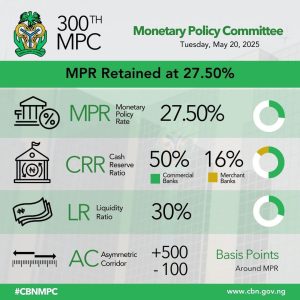

Abuja, Nigeria — The Central Bank of Nigeria’s (CBN) Monetary Policy Committee (MPC) has voted unanimously to maintain the Monetary Policy Rate (MPR) at 27.50% at its 300th meeting held on May 19 and 20, 2025. The decision reflects a cautious approach in the face of easing inflation, improved economic indicators, and lingering global uncertainties.

According to a statement issued by CBN Governor Olayemi Cardoso, the Committee also retained the asymmetric corridor around the MPR at +500/-100 basis points, the Cash Reserve Ratio (CRR) at 50% for Deposit Money Banks and 16% for Merchant Banks, and the Liquidity Ratio at 30%.

The decision was driven by a combination of relative improvements in key macroeconomic indicators and the need to sustain monetary tightening to curb underlying inflationary pressures.

Economic Gains and Progress

The MPC noted several encouraging developments, including:

- A continued narrowing of the gap between official and parallel foreign exchange market rates.

- A positive balance of payments and improved gross external reserves, now standing at $38.90 billion.

- Declining inflation: headline inflation fell to 23.71% in April from 24.23% in March; food inflation eased to 21.26%, and core inflation dropped to 23.39%.

- Strengthened economic growth: GDP grew by 3.84% year-on-year in Q4 2024, up from 3.46% in the previous quarter, driven largely by the services, oil, and non-oil sectors.

The Committee commended government efforts in increasing food supply and improving security in farming communities, which contributed to the downward trend in food prices.

Persistent Challenges and Policy Priorities

Despite these gains, the MPC raised concerns about:

- High electricity costs.

- Sustained foreign exchange demand pressures.

- Structural constraints in the economy.

- Decline in global crude oil prices due to increased non-OPEC production and trade policy uncertainties in the U.S.

The Committee welcomed recent policy measures by the Federal Government aimed at boosting local production and easing currency pressure, while urging sustained reform efforts and increased non-oil exports to strengthen foreign exchange inflows.

The MPC also reaffirmed confidence in the banking sector’s stability, highlighting improved performance indicators and ongoing recapitalization efforts. The CBN pledged to continue effective oversight to ensure regulatory compliance.

Global Outlook and Vigilance

Globally, the MPC took note of the International Monetary Fund’s (IMF) downgraded global growth projections—2.8% in 2025 and 3.0% in 2026—amid persistent global shocks and policy uncertainties.

Given this backdrop, the Committee opted to maintain current monetary policy to gain further clarity on short-term developments while keeping inflation expectations anchored and exchange rate pressures in check.

The next MPC meeting is scheduled for July 21 and 22, 2025.