Abuja, Nigeria

The Executive Chairman of the Economic and Financial Crimes Commission, EFCC, Ola Olukoyede, has urged Moniepoint Microfinance Bank to strengthen regulatory compliance and due diligence in its operations, following a meeting with the bank’s management held on Thursday.

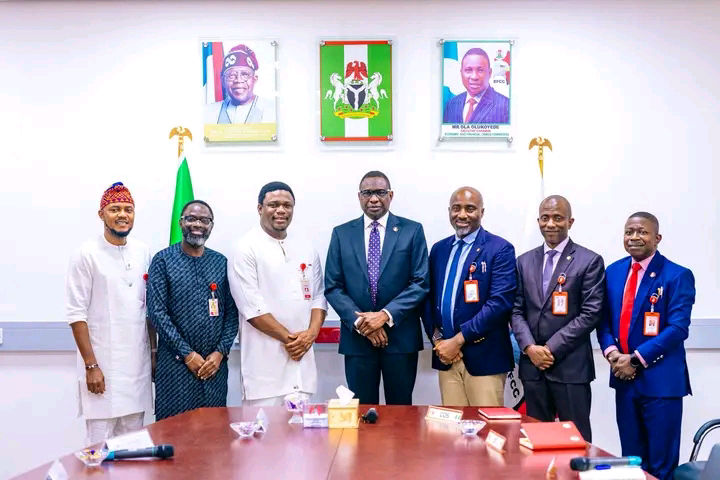

The charge, announced today, Friday, January 23, 2026, was given when the management of Moniepoint, led by its Founder and Chief Executive Officer, Tosin Eniolorunda, paid a courtesy visit to the EFCC headquarters in Jabi, Abuja, on Thursday, January 22, 2026.

Speaking during the meeting, Olukoyede emphasized the importance of strict adherence to regulatory frameworks, noting that strong compliance measures would prevent the misuse of fintech platforms for money laundering and terrorism financing.

He advised the bank’s management to operate patiently within the law, stressing that building and sustaining a business requires discipline, ethical conduct, and respect for regulatory rules. He also underscored the importance of Know Your Customer, KYC, procedures, particularly in line with regulations issued by the Central Bank of Nigeria, CBN, and the Securities and Exchange Commission, SEC, on cryptocurrency transactions.

Olukoyede commended Moniepoint’s management for its resilience and courage in growing the institution despite the challenges of operating in Nigeria, describing the achievement as worthy of recognition.

In his response, Eniolorunda assured the EFCC of Moniepoint’s commitment to regulatory compliance and the safety of financial transactions conducted on its platform. He stated that the bank recognises its responsibility to maintain strong anti-fraud and anti-money laundering frameworks.

According to him, Moniepoint has entered a more mature phase, having strengthened its systems to curb fraud and ensure that accounts are operated only by their legitimate owners. He added that the bank remains proud of the impact of its services in improving payment reliability for businesses and expanding access to credit within the economy.