Reforms Get Tightened Major Growth in Nigeria's Minerals Sector

Summary

- Revenue surged from ₦6 billion in 2023 to ₦38 billion in 2024, signalling a major turnaround in Nigeria’s solid minerals sector.

- Over $800 million in processing investments recorded in 2024, with several major lithium and mineral processing plants nearing completion.

- ₦1 trillion allocated for mineral exploration to improve geological data and attract global investors.

- Crackdown on illegal mining intensified, with over 300 arrests, 150 prosecutions, and new cooperatives supporting small-scale miners.

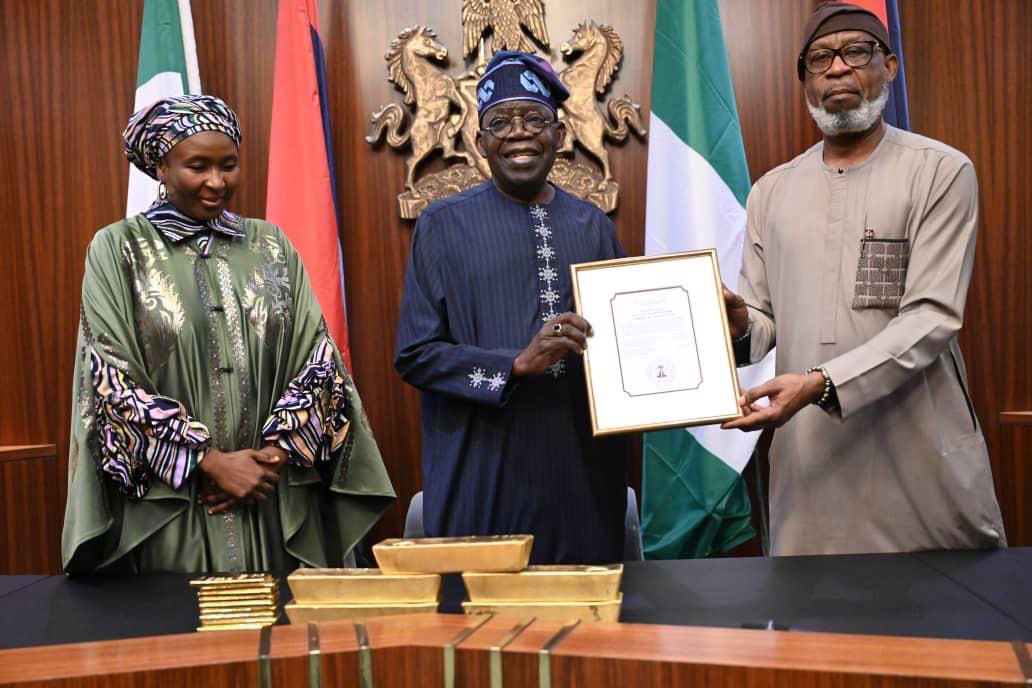

Abuja, Nigeria — The Federal Government of Nigeria says it has recorded a significant turnaround in the nation’s solid minerals sector, with revenue rising from ₦6 billion in 2023 to ₦38 billion by the end of 2024. Minister of Solid Minerals, Dele Alake, attributed the sector’s resurgence to targeted reforms, increased investor interest, and a firm crackdown on illegal activities.

Alake noted that one of the first changes introduced by the Tinubu administration was the tightening of the mining license process. Prospective licensees are now required to present clear local processing plans, a move designed to end the long-standing practice of exporting raw minerals without value addition.

This reform, he said, has attracted over $800 million in mineral processing investments in 2024 alone. Notable among these are a $600 million lithium processing facility near Kaduna and Niger, a $200 million refinery near Abuja, and two additional plants expected in Nasarawa by Q3 2025. These projects are expected to generate jobs, boost technology transfer, and strengthen local economies.

On exploration, Alake said Nigeria had historically lagged behind its African counterparts, spending just $2 million compared to Côte d’Ivoire’s $148 million and South Africa’s $300 million. To change this, the government has earmarked ₦1 trillion for mineral exploration in 2025, laying the groundwork for credible geological data and sustained investor confidence.

The crackdown on illegal mining has also intensified, with over 300 arrests made in 2024, including foreign nationals. Of these, 150 cases are currently in court and several convictions have already been secured. The government is also working to formalise artisanal mining through the creation of over 250 cooperatives, enabling small-scale miners to access finance and participate in legal mineral trade.

Nigeria’s efforts have not gone unnoticed. The country now chairs the African Mineral Strategy Group, a newly established bloc pushing for local value addition and equitable mineral trade across the continent.

Investor interest continues to climb, with the Mining Cadastral Office receiving over 10,000 license applications in the first quarter of 2025 alone.

“We’ve still got work to do, but the direction is clear,” said Alake. “We’re turning Nigeria’s mineral wealth into real economic value for our people, our industries, and our future.”