On Saturday, Gboyega Isiaka, Chairman of the House of Representatives Committee on Polytechnic and Higher Technical Education, announced that as of September, the Nigerian Education Loan Fund (NELFUND) has disbursed N84.2 billion to applicants. This amount includes N27.5 billion for institutional facilities and N56.7 billion for upkeep expenses.

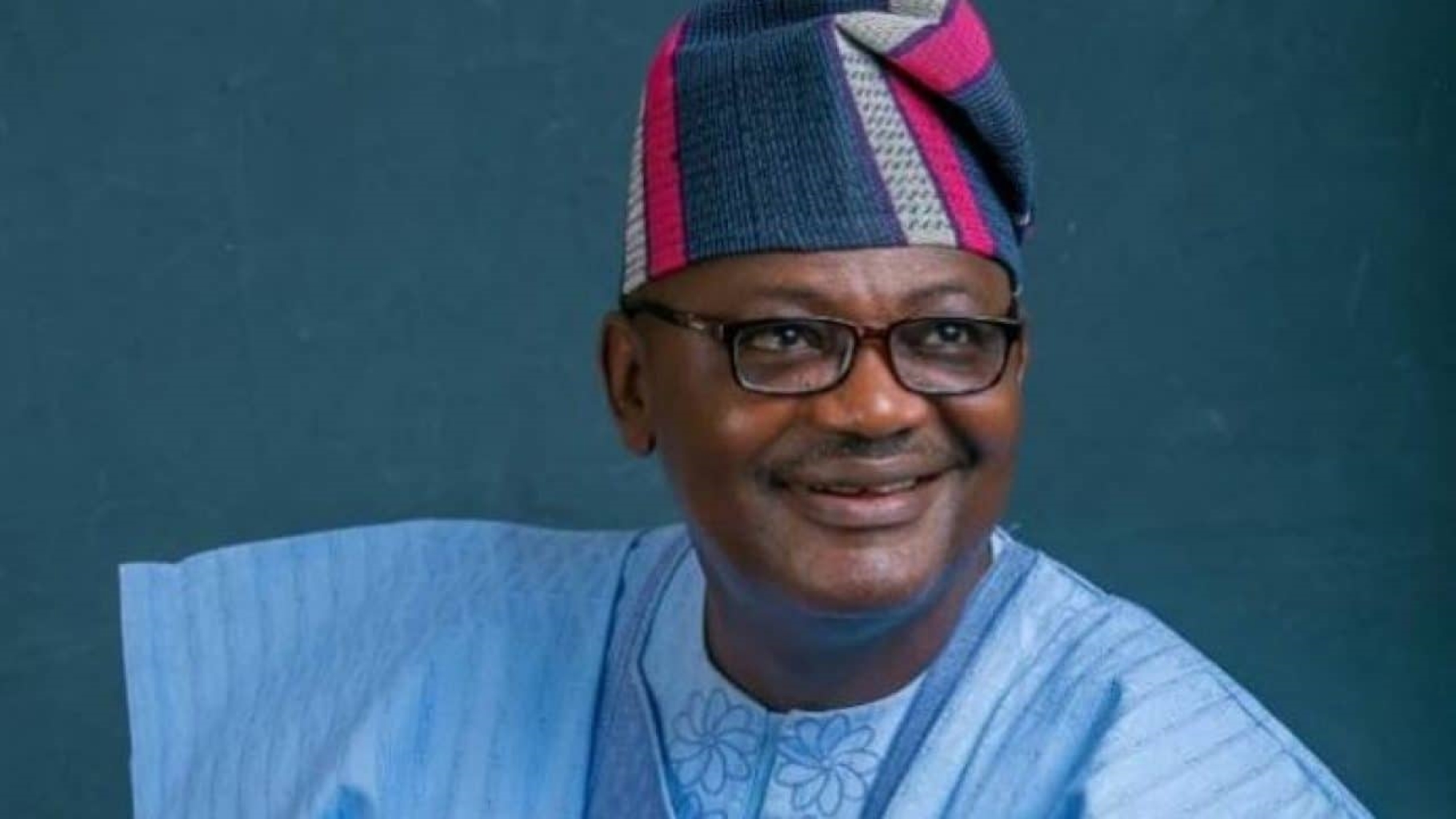

Isiaka, who represents Yewa North/Imeko-Afon Federal Constituency in Ogun State, stated that 351,317 students have registered on the NELFUND portal, with 258,943 applying for either institutional or upkeep loans, or both. He made this announcement at the 36th annual conference of the Federal Government College Maiduguri Old Students Association in Abeokuta.

Speaking on the theme “Empowering The Next Generation: Education As a Catalyst For National Development,” Isiaka highlighted that the Student Loans Access to Higher Education Act of 2024 aims to bridge financial gaps and ensure access to quality higher education for deserving students.

He noted that the new bill removes previous barriers, such as disqualification based on parental loan history, and eliminates the guarantor requirement, making loans more accessible through application and identity verification guidelines.

Under the new bill, students can apply for loans to cover tuition, other fees, and maintenance allowances. Unlike the 2022 law, the 2024 Act eliminates family income thresholds, allowing all Nigerian students to apply for loans and take responsibility for repayment according to the Fund’s guidelines. Repayment begins two years after completing the National Youth Service Corps (NYSC), with an option for extension if the beneficiary is unemployed and can provide an affidavit confirming they have no income.

Isiaka also mentioned that loans will be forgiven in cases of death or other acts of God, and any person found guilty of providing false statements regarding loan repayment will face a felony charge, punishable by up to three years in prison.

He emphasized that the revival of the student loan scheme, which was first introduced in 1972 but later suspended, is a significant step toward expanding access to affordable, quality higher education in Nigeria.

At the event, Mr. Chris Abu, National President of the Federal Government College Maiduguri Old Students Association, expressed concerns about the growing insecurity in Nigeria, which threatens the purpose of Federal Government Colleges (Unity Schools). He lamented the inadequate human resources and poor infrastructure plaguing the education system and called on federal, state, local governments, and the private sector to address these issues.

Abu noted that the insecurity has altered the student demographic in Unity Schools, with a higher percentage of indigenous students, which contradicts the original intent of fostering national unity through diverse student populations.

Barr. Deji Eniseyin, Chairman of the Federal Government College Maiduguri Old Students Association, added that these annual conferences aim to reinforce the unity of the country and that listening to dissenting voices is key to further strengthening national integration.