The Manufacturers Association of Nigeria has stated that the recent hike in the price of premium motor spirit from N568 per litre to N855 will compound the rising cost challenge confronting the country’s real sector.

Recently, the Nigeria National Petroleum Company Limited on Tuesday reviewed petrol prices upward amid the protracted scarcity of the product across the country.

MAN, in a statement, said NNPCL’s PMS price increase would harm the manufacturing sector, which had been struggling.

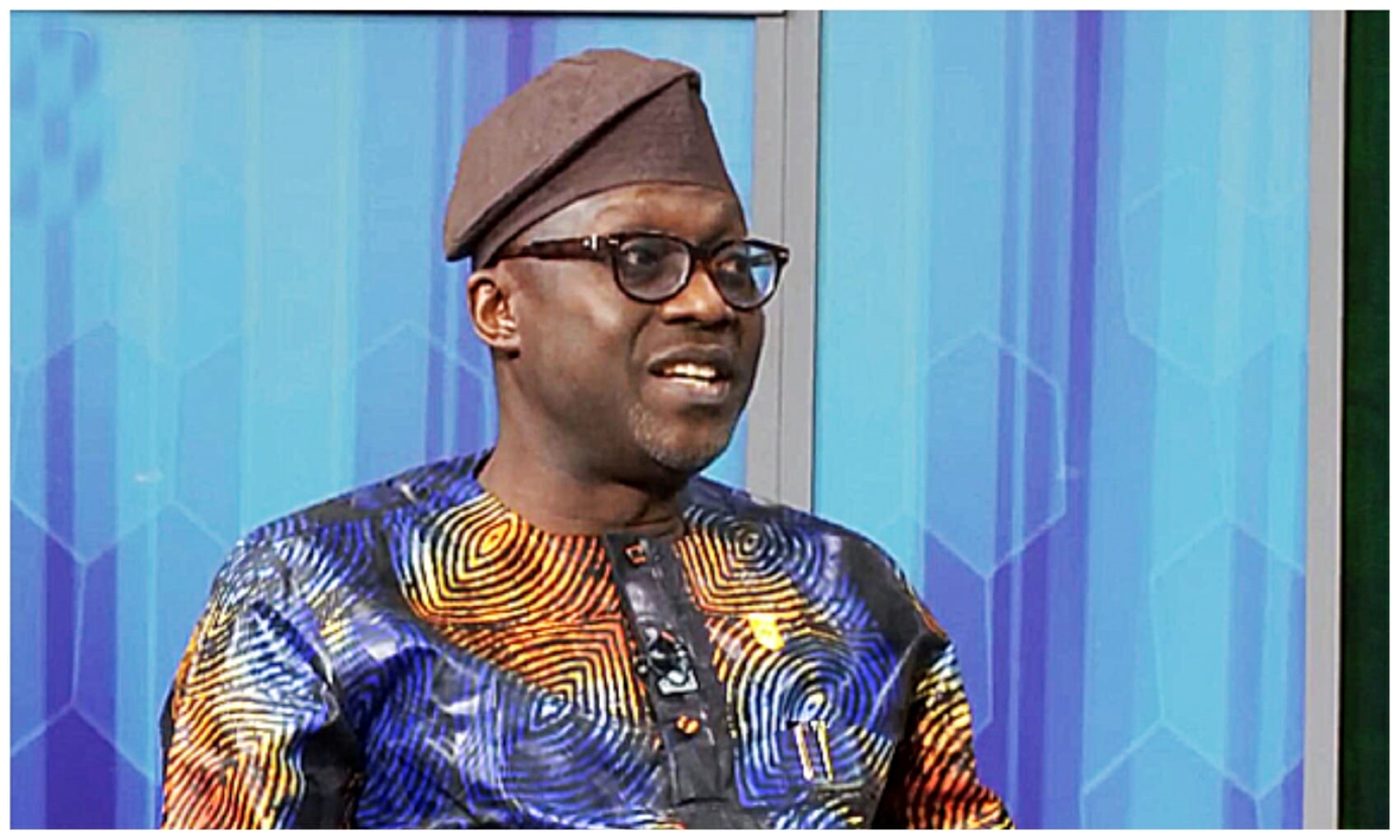

The Director General of MAN, Segun Ajayi-Kadir, noted that the petrol price hike would lead to higher prices of other commodities in the face of the dwindling disposable income of the average Nigerian.

He admitted that with a global increase in crude oil prices and Nigeria’s dependence on imported fuel due to non-operational refineries, a price hike was inevitable.

He said, “The increase in the cost of crude oil will have a direct impact on the cost of importing fuel into Nigeria and expectedly, the NNPC would at some point, adjust domestic prices.

“Also, right from the time fuel subsidy was either reduced or removed, it became inevitable that the price may rise.”

The MAN DG noted that as more of the income of Nigerians goes to transportation and energy, they would find themselves with less money to spend on other essentials, leading to a decrease in demand for non-essential goods.

The economic scenario is likely to contribute to a further increase in inflation, putting additional pressure on household budgets, according to Ajayi-Kadir.

He added that the manufacturing sector’s vulnerability to the developments included the rise in the costs of production and logistics, forcing manufacturers to increase their prices and risk a buildup of unsold inventory and reduced capacity utilisation, which would potentially lead to a downturn in manufacturing performance.

“The increased costs could force some to scale down operations or even shut down if they are unable to pass on the additional costs to consumers,” the MAN DG submitted.

Ajayi-Kadir remarked that small and medium-sized enterprises would be hardest hit by the effects of a PMS price hike as they operate on tight margins.

“Businesses may need to adjust their pricing strategies, which could lead to reduced profit margins if consumer demand weakens.